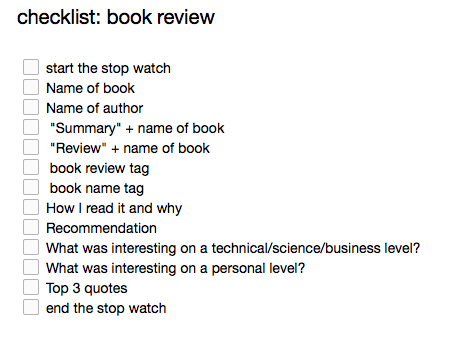

I am trying to find my tone with these books reviews, so they vary in style and size. One of the things that I have started is to write a "book review checklist", inspired by the "Checklist Manifesto" to make it easier and faster for me to have decent quality consistently.

My checklist looks like what you see on the left side. If you are wondering why I include summary: Charlie Munger: The Complete Investor by Tren Griffin than that is quite simple: basic SEO.

I have been inspired to write content here a bit more regularly by a recent interview of Benedict Evans with Bloomberg Radio "Masters in Business Podcast". Here he describes two things. First on how he got a name in blogging:

"(...) I sort of got noticed and you know I spent like two or three years writing about posts and getting like 100 page views a month and then I went through a period where I was getting a couple of thousand page views a day and that sort of happened in the course of 2013."

We are a bit of over focussed on relatively short term outcomes, but more complex elements take time. There is very little magic to that. Also, there is very little magic to how Bendict Evans got the job.

"EVANS: I just asked them for a job. I don’t know why people said it is hard to get a job in (INAUDIBLE), you just ask them for a job, they say yes."

Anyway, back to the book review. How did I read it and why: basically, I am very big fan of the content by Tren Griffin, for example https://25iq.com/2018/04/07/business-lessons-from-mark-leonard-constellation-software/. I have gotten more and more interested in Charlie Munger following the Biographie of Buffet (review of the The Snowball

I listend Tren Griffins book on audible. That makes it difficult to write a summary because I rely heavily on the notes and highlights I can take on kindle.

Recommendation:

Highly recommended if interested in "mental models" and value investing specifically. Without an interest in this, it is not going to be interesting. If you listen to/read farnam street stuff or tim ferris podcasts than this is probably interesting. If not, than buy it cheaply (audible free book) and try if you like it.

Also read:

https://25iq.com/2016/11/25/a-dozen-things-warren-buffett-and-charlie-munger-learned-from-sees-candies/

https://25iq.com/2015/10/30/a-dozen-things-ive-learned-from-charlie-munger-distilled-to-less-than-500-words/

What was interesting on a technical/science/business level?

- The biggest lesson is that it is easier to avoid stupidity than achieve brilliance. If done over a long period of time this compounds and leads to great value.

- What is risk: this I find very interesting because I remember asking my brother this about 10 years ago when I finished school and he was working in the quantitive section of a large bank. I have never found a useful definition of risk (volatility makes not sense for me because volatility measures volatility not risk - otherwise it would be called risk).

What was interesting on a personal level?

Nothing to comment here in particular here, a very business focussed book.

Top 3 quotes

Not available because I consumed this on audible.

Time taken to write this post

30 minutes.