I have come across Win/Loss analysis late. I believe it is the most powerful tool to operate and analyse a product. Since a business is just a collecting of products, it is very helpful to analyse businesses too.

In a business, there are infinite number of issues one can discuss. For example: should we change the packaging? Hire in a Social Media person? Change the CRM? Buy forklifts instead of leasing them?

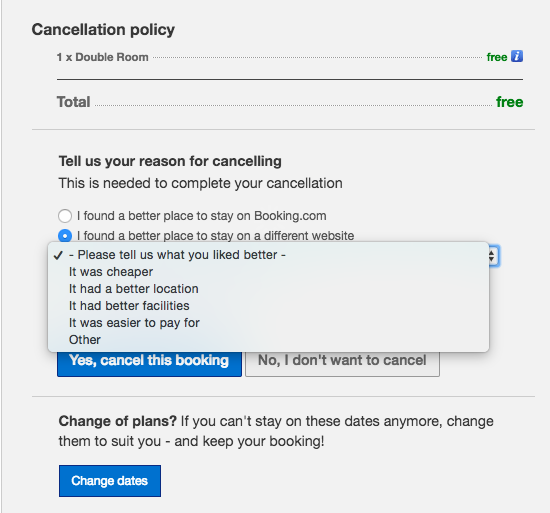

Upfront an example from booking.com:

Win/Loss Analysis by Booking.com

These are nice debates where everybody has an opinion but they are irrelevant as such. Your problem is know what you are solving for. It is not discussing the Pros and Cons of Social Media interns vs. an Agency unless that turns out to be the real problem.

So, we define our goal as knowing: what do we need to do to increase revenue?

Win/Loss Analysis - The Sales Process

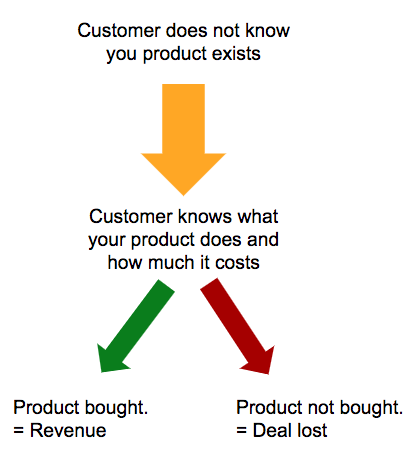

Looking at selling a product backwards, there are three steps:

Customer either buys or doesn’t buy the product

Customer understand what the product does and it’s price

Customer is aware of the existance of the product

The product that I buy most often is books. For the absolute majority of books I do not know their existence. That is to say, if I’d search for books on “Australian folk dances” I would not recognise a single one.

The steps to purchase

Other books, I am aware of and know what they are about, for example if I take the non-fiction section of the annual “FT/McKinsey” Book award list, I’ll know about half of the books on there. But have probably bpught only one or two.

Lastly, there are the books that I actually have bought. Those are the three steps that exist, obviously what they they are varies wildly by industry. The essence of the first step is that success at this stage is what you recognise as revenue.

For example, a free trial of a product is not completion of the last stage. It is the second stage because the customer has not bought the product. A customer walking buy your shop in a pedestrian area of a town is not in the second stage, because the customer does not know your products do and how much your charge for them.

Ignore the wins, look at the losses

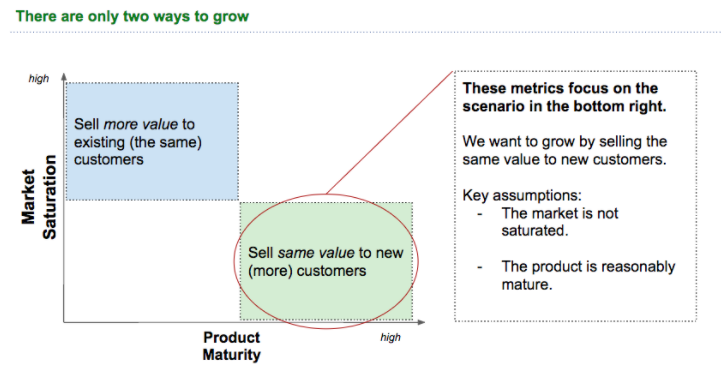

Your goal is to sell the same product a more often. When you talk to customer who bought the product, they say things they need other than that. Does that help you sell the existing product more often? No. It helps you sell more to existing customers.

Do you want to increase the ticket size per customer or do you want more customer for the same product?

To find out how to sell more of the same product - you want to talk to customer who have not bought that product! The will tell you why they have not bought the product.

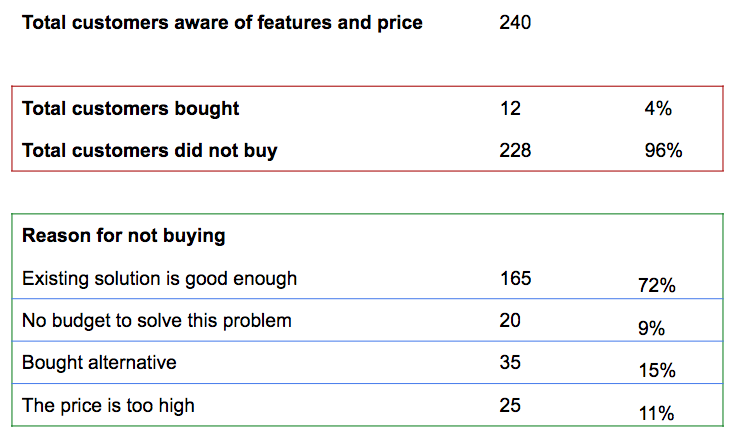

Let’s look at this example. You got 240 potential customers to the point that they know what problem your product is solving and how much that costs. Now, 12 people buy but 228 did not buy.

Simplified win/loss analysis

If you now look at the reasons why customers don’t buy it appears that the majority thinks whatever they are using is good enough. Since that is 72% of the losses you focus on that. Not whether you should hire somebody for social media because nobody is not buying because the lack of a social media presence. For those 72%, there are three options:

Your product is actually not much better than the alternative (product management problem)

You are unable to communicate the value (product management problem)

You pitch the product to the wrong people (product management problem)

Getting to the heard of this problem is what you need to spend your time on.

Digression for example at the beginning: discussing packaging as such is pointless if your customers buy online. It is only relevant for one goal: increase word of mouth business or improve rating to be listed higher as competitors. Word of mouth and reviews are not relevant than this is time wasted. Good for your ego and nice to discuss but not relevant for the business.

Win/Loss Analysis - What is your competition?

A key mistake is the perception of the competition. You probably think that your competition is Google, Siemens, SalesForce, Zappos, SAP or some other fancy company. Because of that, you think you need to offer stuff that Google, Zappos have - like massive customer success operations, be at expansive conferences, have a big twitter team.

This is a mistake and it is an expensive mistake. Your competition is whatever the customer are using to achieve what they want to achieve. Nothing else. For example I buy a lot (too much) clothing at Uniqlo. Quite often I try something on and consider. In the absolute majority of the cases where I do not buy a new jumper, I do not go over to H&M or Zara and buy the same thing there. I fall back to loads of existing jumpers or some free start-up hoodies that constantly gather.

Uniqlo is not competing against H&M and Zara for my Euros but against free start-up hoodies and something bought abroad for memory.

This holds true in B2B as well. For example, let’s say you build tools to collect 365 Degree Reviews from team members in order to improve promotion in companies (made up example).

When you are selling this to companies you believe you compete with any of the tools that exists for that. But your biggest competitor is probably the fact that people don’t actually do 365 Degree Feedback.

This is usually the case. The competition is the status quo or non-consumption. People don’t actually have the problem you are solving.

What DO you need to do to increase revenue?

You need to do one of two things: reduce the reason why customers are not buying or make more offers to potential customers.

If you cannot reduce the reason why customers are not buying, while keeping unit economics sustainable, you probably want to exit this business. If the ratio of bought/not bought is healthy and there is a large available market you probably want to focus on getting your product in front of your customers. If you can’t do that your market size is the problem and you either want to build a nice boutique business or exit this business. (As for example happend to www.die-masterarbeit.de of which I co-founded).

Operationalising win/loss analysis

Doing win/loss analysis is inconvenient and not pleasurable. The problem is who does it. In my personal opinion it should be a key metric for the all product managers to consistently understand the win/loss rationale.

Also see my article on OKRs for Product Managers that touches on the same point.