The goal of operating within a company is to generate shareholder value. And, doing that it should not harming the environment, employees or the state. Yes, shareholder value is the focus of the company. The primary institutions to care for the environment, equal opportunity and intergenerational justice are the state and other stakeholders.

Understanding how shareholder value is being generated is therefore essential if you provide labour (as an employee), direct resources within one company (as a manager) or direct resources across multiple companies (as an investor).

I am becoming more interested in understanding how to allocate resources between companies. Plus, I enjoy learning and because of that I will analyse the stocks of software companies listed in Frankfurt.

But before starting that I want to structure my thoughts, otherwise I get lost in information. There are two typical sources of comparisons that I have come across:

- Comparison of data across time

- Comparison of data against other companies

But, I am not really comfortable interpreting this. If I know that a company has more cash on the balance sheet compared to last year - is this good or is this bad? If the company has the highest profit margin compared to “competitors” is this good or bad? Plus, who defines these competitors?

What follows is me trying to think through how I’d value a company before I start doing that with the software companies listed in Frankfurt.

The initial budget

A company starts off with an initial budget. If the company is a consulting operation, this could be the knowledge, reputation and contacts of the person starting it. Example: if you have been a well known professor of accounting it is probably straightforward for you to start an accounting consultancy business. Your prior knowledge, reputation and contacts to potential clients would constitute your initial “budget” that allow you to generate cash through selling your time in the form of consulting. In essence, your time has become a product through your knowledge, reputation and contacts.

The problem is that it is not possible to have an account that has some units of “knowledge, reputation and contacts” on it which you could transfer to a somebody. If that where possible, you could send a couple of units “accounting knowledge and reputation” to somebody and get a % of the money they earned because you gave them the knowledge, reputation and contacts.

Instead of the “accounting knowledge and reputation” account we just have accounts with cash. We want to give this cash to somebody so that they do something with it that results in more cash.

On the one hand, cash is more useful than the account with “accounting knowledge and reputation” on it because we can use it for whatever we want. On the other hand, you have to actually come up with something for that money to do so that it generates more money.

What do I get for my budget

If I had a budget of accounting knowledge, reputation and contacts then I would give that to the person from whom my % would be the biggest amount of cash. That would depend on my negotiation with the person about the relative share of the cut I get, plus my estimation of how much he will make in the future.

Translating that back to an account with money: there are two ways I can get a return on my budget - either I get cash back from a business or the cash stays in the business and as a result, my share of that business gets more valuable. Whether I am able to convert that share of a business into cash is a different question - somebody needs to be willing to buy that share (or the whole thing because 100% of the shares is the whole thing).

That is a serious problem - there are websites that collect other websites where people are trying to sell their businesses! unternehmensnachfolgebörsen.

Value of a share = value of a business / number of shares

Next, I have the problem that one of the two ways of getting something for the budget depends on the opinion of other people - that is the price of my shares. If you have ever sold something it is quite obvious that the price for things is in no way rational in the short term. I will leave this out for now and assume it will take care of itself over the medium term.

Still, the question is how to value the company. If we look back at the example above, where we compared to a person to whom we have given accounting knowledge, reputation and context as the amount of cash that we get back compared to the amount of cash we put in.

Because a company can live forever there are two scenarios to consider. I will use a different example as before for two reasons: 1) I did not plan this article through and 2) I am making a different point with this example then the previous one.

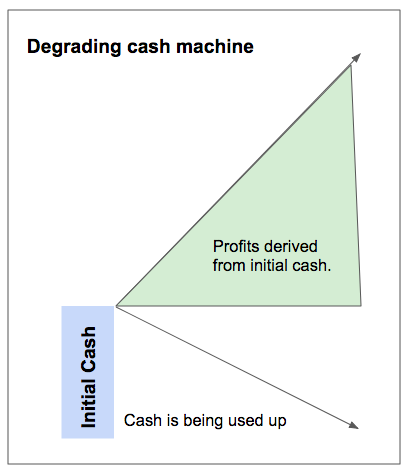

Scenario 1 - Slowly degrading cash machine

In this scenario I put in some cash - say I buy 500 skates boards to rent them in a park. Over time two things happen: 1) cash is being generated and 2) the skateboards break down.

A slowly degrading cash machine

In the graph, “cash is being used up” stands for skateboards break down. This is cash because we have used the cash to buy them and cash generally is a good unit of account. The green thing is the cash generate over the lifetime of the business. It is bigger than the blue block, so that is quite nice. When the all skateboards are broken, nobody cares because they earned more than they cost over time.

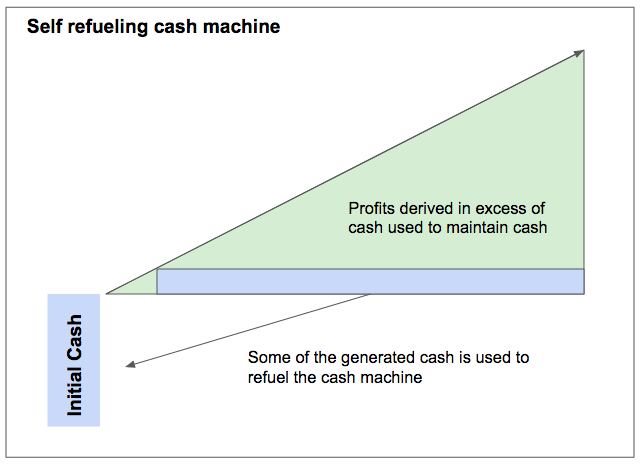

Scenario 2 - Self refueling cash machine

The first scenario makes sense. The second scenario is that a company does not just stop after the initial budget is used up but actually takes a bit of the profits and does something with it to make more cash.

For example, instead of letting the skateboards break down, the company takes that cash and repairs/buys new skateboards. And ideally (!) can rent these skateboards for a higher price or at least the same price. More realistically though, the first skateboards that were rented out where rented out at the highest price and from now on the profits from skateboard renting drops.

The self refueling cash machine

The issues is that the cash can be repleted from three sources: debt, selling of new shares or profits. So it is not as easy as this graph shows but I will learn from application.

Concrete terms for the company analysis

For the below list of companies I want to answer the following questions:

If I buy the company for a given price, will the company generate more cash than that price? (= scenario 1)

If I buy the company for a given price, will the company do something with that cash which enables the company to generate more cash in the future (= scenario 2)

These are the companies that I will put a value on:

ATOSS SOFTWARE AG

COMPUGROUP MED.AG O.N.

FABASOFT AG

FYBER N.V.

GK SOFTWARE SE

INVISION AG

ISRA VISION O.N.

MEVIS MEDICAL SOL.NA O.N.

NEMETSCHEK AG O.N.

NEXUS AG O.N.

PSI SOFTWARE AG

RIB SOFTWARE SE

SAP SE O.N.

SOFTWARE AG O.N.

USU SOFTWARE AG