This is a blogpost that was initially meant to be a note for myself. I am again writing it as a blogpost without a lot of care. I plan to spend about 45 minutes on this, I will also take positions that might be wrong.

A friend of mine recently started working at the combined company following the merger of Aricent & Altran.

Aricent: Launched in 1991, as a split of from Hughes Electronic with Sequoia. That in and off itself is really interesting, since it is a type of deal that does not feel like Sequoia from today’s perspective. Hughes Electronic does tie back to the Hughes corporation, which is the company run by Howard Hughes (the model for Tony Stark and other movie Characters.

My main question is: What was the Sequoia Investment thesis in this company? Was this a product company that moved to a service provider?

Altran: Launched in 1982, by two Frenchman who where at KPMG prior. Or more accurately they were at Peat Marwick before which is the P and M in Klynveld Peat Marwick Goerdeler (KPMG).

What is very interesting in light of the merger with Aricent is that Altran has been growing through M&A in the past. Starting in France than across Europe and the US, including buying the assets and brand of Arthur d Little. From Wikipedia: “In the second half of the 1990s the company was acquiring an average of 15 companies per year.” This is quite an astonishing number. I would love to understand the rationale better.

Business Model:

Altran is a service provider. So in essence what a service provider does is sell time of its employees. There are essentially two ways to do it:

bill time and material like a law firm

bill based on a certain delivery, like a project deliverable

share project risk like a take share of the revenue generated from the product

In all cases the IP of the work ends up with the customer. The costs are basically your employees. In the most simple form the business model depends on billing the customer more for the labour than you pay labour.

Outsider perspective

If the understanding of the company is correct, then Altran should be driven by the availability of skilled labour and the the price it can therefore set for labour. Capture a surplus in high times (now) and remove people fast in a downtime (2008 - 2011 or so)

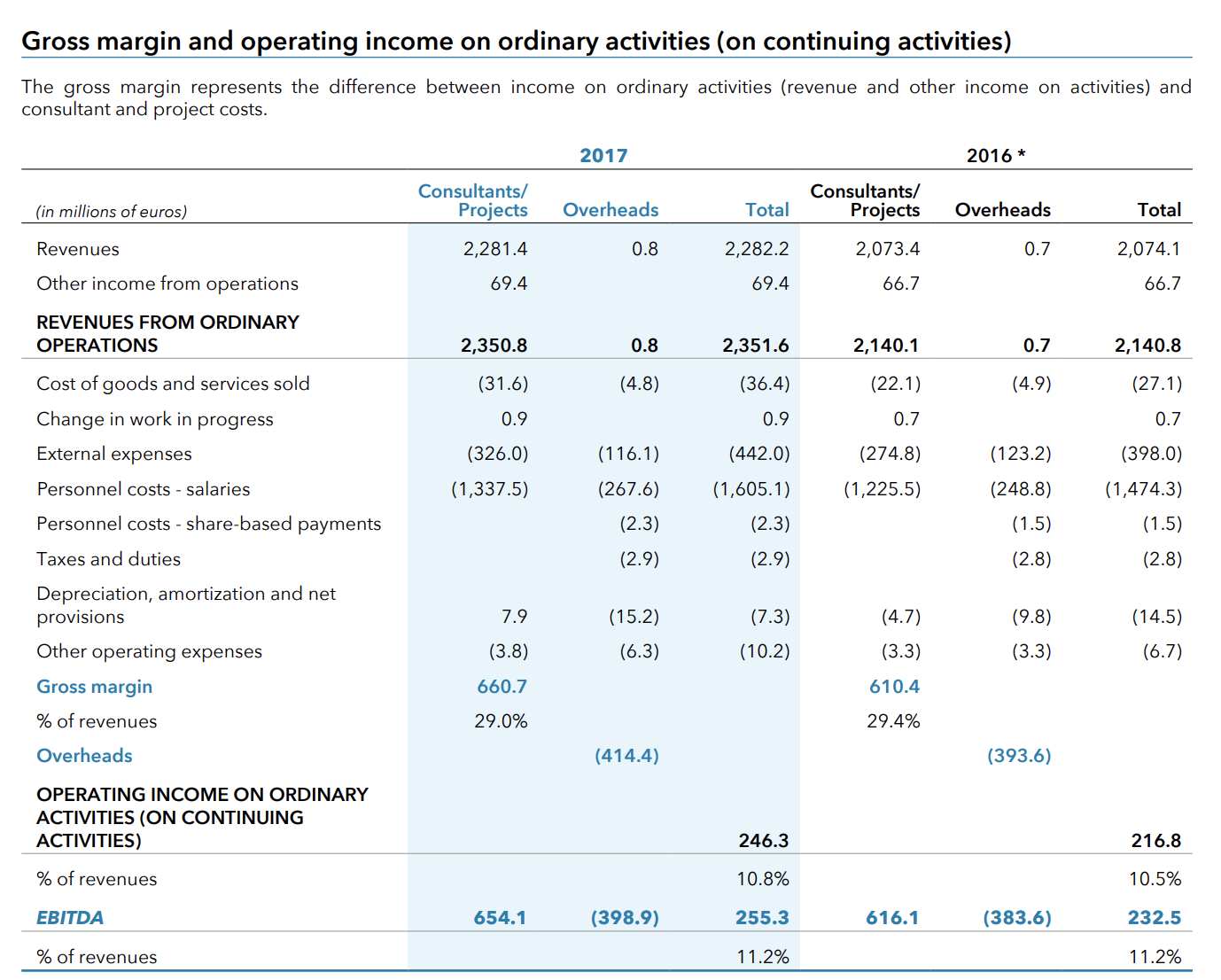

If I just look at 2017 in the annual report I find this data (screenshot from the annual report):

Essentially, it looks like Altran is able to bill its labour at double it’s barely double its cost. Hmm. Anyway, the time is up. I might continue this post or I might not.