It appears that price reductions and discounts are often done without a clear understanding of the goal. Of course, as consumers we see discounts nearly every day from clothing, to plane tickets and other products. But, this does not explain if and when discounts makes sense and when they don’t.

In this post, I am will go through an example both of potential goals as well as do the math on whether a price discounts is the right tool to approach that goal.

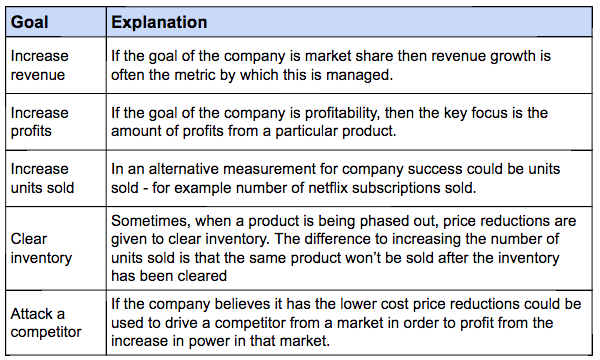

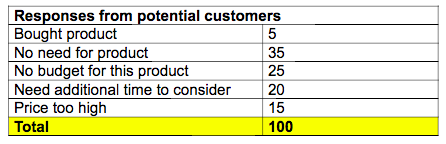

From a strategic perspective there are 5 potential goals:

Strategic reasons to drop a product price temporarily

This is a football net.

To make these clearer we will be working with an example. I'll be using a company that sells footballs. I think everybody know what those are.

Also, football nets will play a role. Football nets are those things you can carry balls in. See picture.

If you are interested in the excel from which I am taking screenshots, you find that here.

Example Set-Up

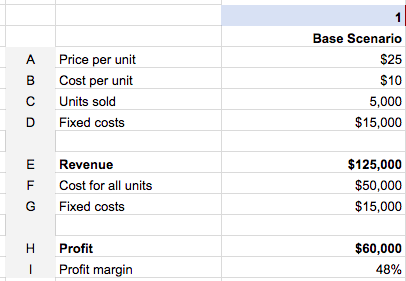

Price per unit: The price a customer pays for one ball

Cost per unit: The cost of making the ball, shipping it to the customer, with packaging, shipping and everything else associated with one ball.

Units sold: Number of units sold

Fixed costs: Costs associated not with selling one ball but with the business in general, like the rent of the office or the tax advisors. This does not change with the number of footballs sold.

Revenue: That is simply (price per unit) x (units sold). In this case: 25$ x 5,000

Costs for all units: (costs per unit) x (units sold). In this case: 10$ x 5,000

Fixed costs: Explained above, so in this case $15,000

Profit: Revenue - fixed costs - costs for all units. So in this case: 125,000$ - 50,000$ - 15,000$

Profit margin: (profit)/(revenue). So in this case: $60,000 / 125,000 = 48%

Goal 1: Reduce prices to increase revenue

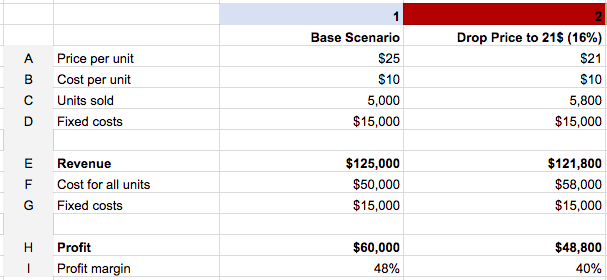

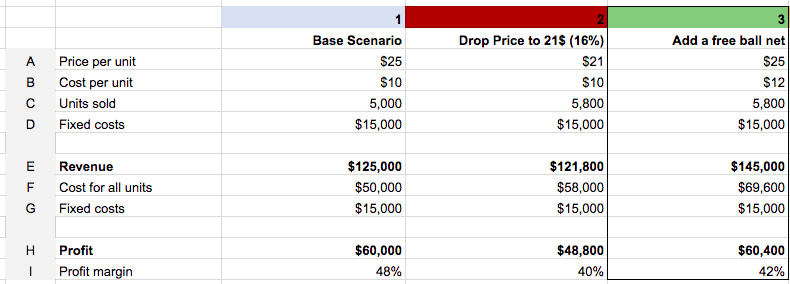

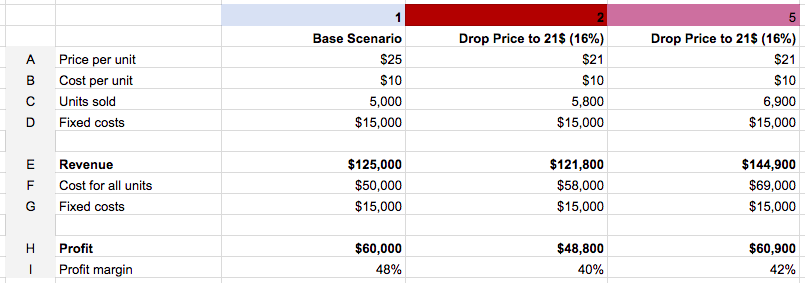

The question is this: if we decrease the price by 16% and our demand increases by 16% does our revenue increase? (Yes potentially there could be an increase in demand higher than 16% - check out the excel to model that yourself). Let's look at the numbers.

First, we drop the price from 25 or 21 USD, that is line A. This is a 16% drop (4/25 = 0.16). Now, let’s increase the demand by 16%. Our new number of units sold is 5,000 x 1.16 = 5,800 units, which you find in line C.

This just means: our price dropped by 16%. Our volume increased by 16%. What are the effects:

Revenue: decreased from $125,000 to $121,000. We have not achieved our goal of increasing revenue because revenue has dropped.

In addition, we have eliminated $60,000 - $48,800 = $11,200 in profits. That is also not good but does not concern us strategically because we want to grow revenue and not profits.

First conclusion: if we drop price by 16% and demand increase by 16% we don't achieve our goal of increasing revenue and we also loose profits. You can do the math based on the excel linked above, in short - you would need an increase of demand by 20% in exchange for a drop in price by 16% to increase your revenues.

Goal 1 - Increase revenue. Additional considerations.

Besides the simple numbers we have just done, there are other consideration when looking at decreasing price to increase revenue. Let’s go through a couple of them.

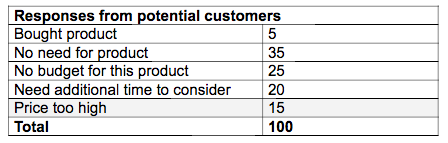

Price discounts only work for customers you lose because of the price

If you make 100 sales pitches per month, have 100 people visit your website or have 100 people come into your store - a price discount does not increase this number per se. If only affects the sales pitches you make and which you lose on price.

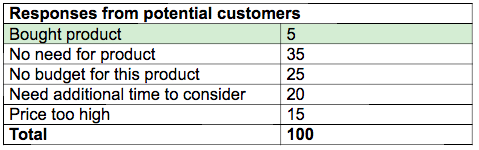

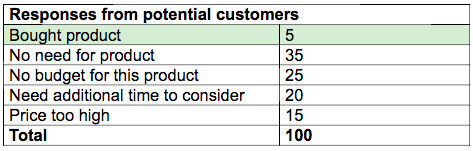

Simplified win/loss analysis results to understand what pricing drives

If this is the split of the results of your 100 pitches, you can only expect an effect on those 15 pitches that are lost on price. That is the number marked grey in this table.

Without massive advertisement (which has a cost) you will not increase your revenue through a decrease in price. In other words: if you do not reach your customer, a price of 0 does not change the number of customers you reach.

Combining this with the above: the 16% increase in units sold we assumed above does not just happen. It still needs advertisement. Most important customer need to know what the price is in order to buy because of a lower price.

Alternative: spend the money to generate more leads

If we need to spend money to broadcast our message of lower prices. We could also spend the money on increasing without lowering the prices. In other words – increase the number marked yellow.

Why not spend the money you spend anyway without dropping the price?

Alternative: spend the number on training/improving sales

Another alternative use of the cash you will spend on telling people that you dropped prices is to spend it on the conversion rate. You could spend the money on inviting all your existing customers to lunch to understand why they bought. You could hire a store assistant or spend the money on training your sales team or update their tools and systems. Or you spend the money on new packaging so that the potential customers you do have understand the benefits and are persuaded to buy.

In other words, change the number in green by improving your sales game.

What if price is not actually the reason why you loose business?

In short: first understand the reason why customers are not buying. If that is the price, there a discount might help. If it is not the price, a discount won’t help and you might end up only loosing money.

Goal 1: Give something for free instead of decreasing the price

An alternative to dropping the price is adding something for free. For example, if you are selling footballs you might add a free ball net.

For example, The Economist is currently adding a free USB stick. Certainly not because the average Economist reader does not have the money for a USB stick.

What about something for free instead of a cheaper price?

But why is this a good alternative? There are obvious strategic reasons – you do not train your customers to expect discounts. You can add variety to your campaigns by adding different stuff but discounts are just discounts. As an idea, you could add an hour of “free consulting” from your CEO/Product Manager/Head of Sales and so actually learn more from your customers.

Of course, this “soft stuff” is not enough. Let’s look at the example numbers. Our goal is still the same: to increase revenue.

What happens when you give something for free?

Our price stays the same, $25 (Line A). Our costs increase by $2 because we have to buy the ball net (Line B). We assume that our units sold go up by 16% because our customers really like the ball net. That assumption is basically on the same level as assuming demand increases by 16% if you drop the price by 16% - both need to be tested. Let’s look at the effect:

Revenue: revenue is up. We have achieved our primary goal!

Profits: Increased by $400 as well. Our profit margin is a bit lower but since we are looking for market share, not profitability that is alright.

This alternative of giving something for free seems to be much more appealing than dropping the price! Of course, it hinges on the % increase of orders but it is not obvious that people like free stuff less compared to reduced price.

Goal 1 - Summary

First, understand why customers are not buying. Second, consider adding a free gift but keeping the price.

Goal 2 – Increase units sold

Now, our goal is to increase the number of units sold. This is only different from revenue because sometimes this is a better reflection of the stage of your company.

For example, for Uber the number of signed up drivers might be the key metric because it is an indicator of market power. Similarly, netflix regularly reports the number of subscribers as a key metric. The assumption probably is that once you have the customer subscribed you will turn a profit at some point.

In these scenarios a table like the above makes less sense because you have to take into account the available capital. Business like Uber and Netflix are able to raise the money to finance the growth even at a per unit loss because the monetisation is assumed to be possible

A meaningful way to think about this is not the revenue calculations we did above but understand the reasons why customers are not buying.

If we look at the same table as before, we see a 5 people actually buy the product out of 100 we pitched.

Why uber and netflix don't care about prices

So, in a business where the potential base is extremely large (like becoming an Uber driver or subscribing to Netflix) you likely focus on the other reasons why customers are not buying.

Your whole focus is the customer acquisition and the price is only a small part of this. A bigger problem is getting everybody to know about Netflix rather than lowering the price. That’s probably why Netflix initially did not care about customers using the accounts of their friends. In general the problem is not the price of netflix, especially when customers get older, but that everybody needs to know about it.

Unfortunately, your market is probably to small to justify this strategy.

Goal 3 – Clear inventory

A case in which price discounts do often make sense is clearing inventory. Inventory can be seats on a plane that flies anyway, empty hotel rooms at the end of a day or clothing from the previous season. While the cost of clothing obviously does not go to Zero, it is looked at in comparison to the new season stuff. At the end of the Winter season, it is cheaper for H&M to drop the price drastically for customers to buy it rather than the alternative. The alternative would be to throw away the stuff to clear the retail space for new season stuff which does have a higher price.

The difference to the example given at the beginning is that the “marginal costs” are close to 0.

The equivalent would be where the next football does not cost $10 but maybe $0.5. That would mean you are turning a profit whenever you sell higher than $0.5. Typical examples:

plane seats (the plane is flying anyway)

hotel rooms (hotel is built and rooms are equipped)

clothing from last seasons (the space needs to be freed up to for the next seasons)

Goal 4 – Increase Profits

As we have seen above it is quite difficult to increase revenue through price reductions. Increasing profits is even harder because profits are: (price) x (units sold) – (units sold) x (cost per unit) – fixed costs = profits.

If you are dropping price you first need to sell more to get to the same revenue. Next, because the difference between price and costs per unit has been decreased you need to sell an extra amount more to increase your profits.

What you need to increase profits through reduced prices

Blue (Column 1) is our base scenario. Red (Column 2) is what we looked at before. Violet (Column 5) is what we look at now.

The question is: if we drop the price by 16% (row A) by how much does the demand need to increase in order for profits (row H).

I have played around with the demand figure until I got the profits above $60,000.

The answer is: for a discount of 16% sales need to grow by 38% for the profits to increase. That is massive increase in demand, possible but unlikely.

I would claim that unless your whole reason of being is to cut costs, like Ryanair or Aldi it is extremely difficult to grow your profits through cost leadership.

Goal 5 - Attack a competitor

Included for the sake of completeness - I don’t know much about this so I will not comment deeply.

Only one thought: if you drop prices - the opponent either follows this move or does not follow.

If the opponent follows by also by reducing pricing, you want to make sure that they leave the market. Because if not, you might just end up with the same market at lower prices. That would the worst outcome.

Now, if your competitor does not follow but stays in the market with a higher price point and you don’t win over customer from the competitor you know that the problem is not the price. It is the product.

Summary

Unless you are clearing inventory, price reductions rarely work. Re-visit the goal you want to achieve and consider the alternatives.